State Minimum Wage Increases Going Into Effect In 2024

From the Astrix Scientific Staffing Blog

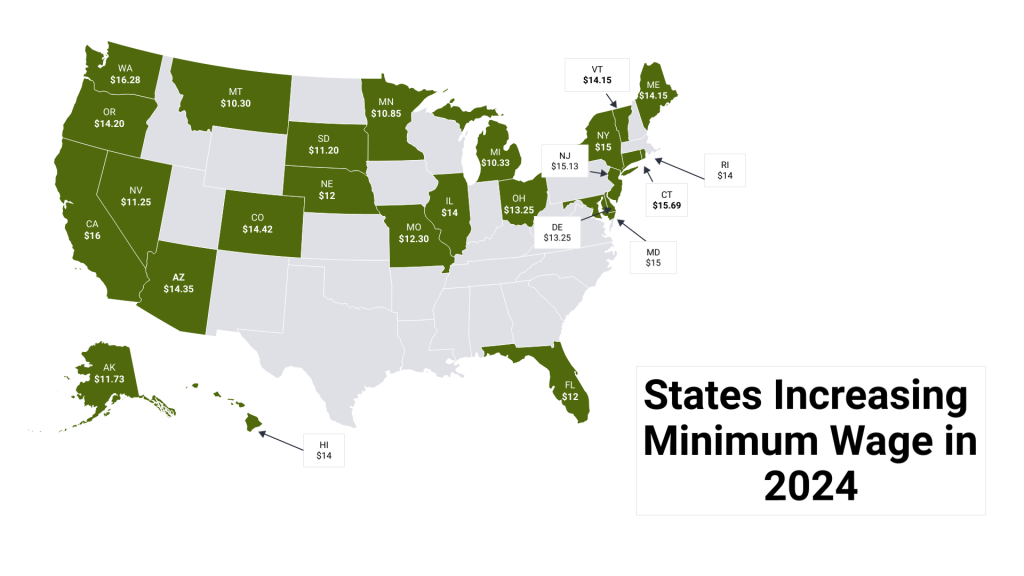

In 2024, several states are set to increase their minimum wage rates. This is due to scheduled increases or lawmakers having indexed the minimum wage to inflation, using the Consumer Price Index as their gauge. Among the states with scheduled increases in 2024 are California, Illinois, Massachusetts, Michigan, and Virginia. These states have been gradually increasing their minimum wages in recent years and will continue to do so.

Understanding Minimum Wage Laws

Minimum wage laws set the lowest amount that employers can pay their employees per hour of work. These laws are designed to protect workers from exploitation and ensure a basic standard of living. Employers to stay informed about the minimum wage rates applicable in their jurisdiction, as these rates may vary at the federal, state, and local levels.

Federal Minimum Wage:

The federal minimum wage is the lowest hourly rate an employer can pay most employees, as mandated by the Fair Labor Standards Act (FLSA). Since 2009, the federal minimum wage is $7.25 an hour.

State Minimum Wage:

In addition to the federal minimum wage, each state has the authority to establish its own minimum wage laws. State-level regulations can vary significantly, with many jurisdictions setting minimum wages higher than the federal standard to account for differences in the cost of living. In recent years, a significant trend has emerged as multiple states actively work towards achieving a $15 minimum wage. To attain this goal, some states have adopted a strategy of implementing scheduled annual increases to steadily progress towards the desired threshold.

States with New Minimum Wage Increases In 2024

Effective Jan 1, 2024

Alaska, Arizona, California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maine, Maryland, Michigan, Minnesota, Missouri, Montana, Nebraska, New Jersey, New York, Ohio, Rhode Island, South Dakota, Vermont, Washington, and Washington DC.

States with additional guidance:

- Minnesota & New Jersey:

- Minnesota: $10.85 for large ($500k+ annual gross revenue), and $8.63 for small (less than $500K annual gross revenue).

- New Jersey: $15.13 for businesses with 6 or more employees and $13.73 and businesses with fewer than 6 and seasonal employees.

- New York:

- New York City, Westchester, and Long Island minimum wage is set at $16.

Effective After January 1, 2024

- Florida: For employers with 6 or more employees.

- Scheduled annual increases of $1 every September 30th until it reaches $15 on September 30, 2026.

- Nevada: (starting July 1, 2024, minimum wage will rise to $12 for all employers regardless of health benefits offered)

- Oregon: (starting July 1st, 2024, $15.45 for employers in Portland Metro, and $13.20 for nonurban counties.

- Standard employer minimum wage will be adjusted annually based on any increase to the Us City average Consumer Price Index for all urban consumers).

- Washington: (Effective July 1, 2024, the District’s Minimum Wage and Living Wage will increase to $17.50)

Conclusion

As several states across the United States implement increases in their minimum wage rates in 2024, it is important for employers to understand and comply with these laws. Whether these adjustments are scheduled increments or linked to the Consumer Price Index, staying informed is key.

By staying informed, communicating transparently with employees, and regularly reviewing and updating policies, employers can create a workplace that values fair compensation and adheres to legal standards.

Additional Reading

State Minimum Wage Laws: Department of Labor

About Astrix

At Astrix, we understand the unique needs of life science companies and provide customized staffing solutions to meet their hiring goals. With our specialized service, proprietary data sets, and comprehensive approach, we ensure that our clients have the right staff in place at the right time.

Contact us today to learn more about our customizable staffing services.

This blog post is for informational purposes only and should not be used as a substitute for legal advice. Consult with your legal counsel to ensure your company’s policies and practices align with the updated laws and regulations.

Case Study: LabWare Centralized Data Review for a Global Biopharmaceutical Company

Overview A global biopharmaceutical company specializing in discovery, development,... LEARN MOREWhite Paper: Managing Data Integrity in FDA-Regulated labs.

New White Paper LEARN MORELET´S GET STARTED

Contact us today and let’s begin working on a solution for your most complex strategy, technology and staffing challenges.

CONTACT US