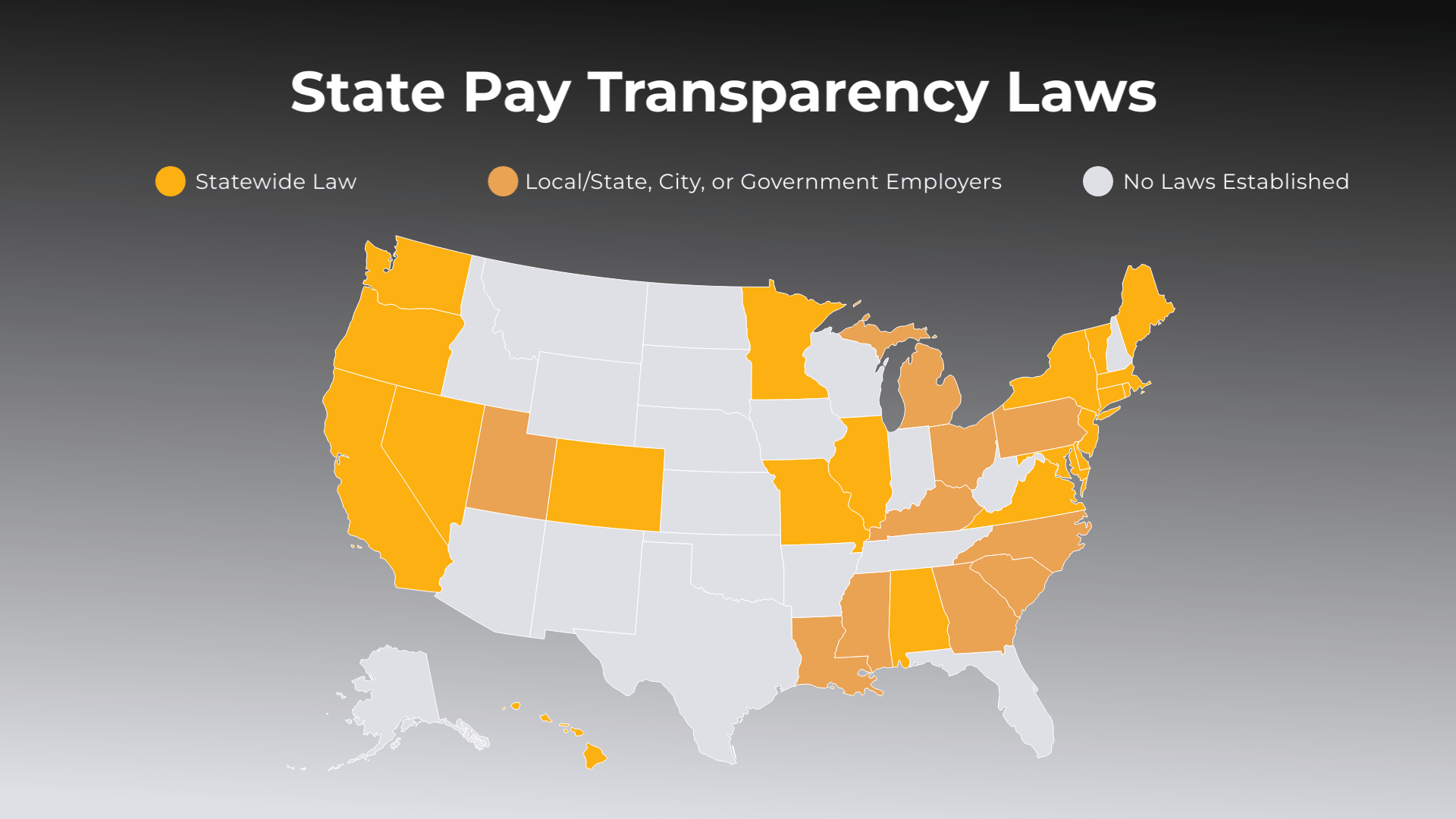

A Guide to State Pay Transparency Laws for Employers Part 3

In the ever-evolving landscape of employment regulations, the movement towards pay transparency is gaining momentum. Part 3 of our series delves into the latest developments, focusing on updated and new states that have taken a stand against pay history questions.

Read part 1 and 2 of this series:

- A Guide to State Pay Transparency Laws for Employers Part 1

- A Guide to State Pay Transparency Laws for Employers Part 2

The Latest States on Board:

As the momentum for pay transparency grows, it’s crucial for employers to stay informed about the latest changes in state regulations. In this guide, we’ll discuss the updated and new states that have joined the movement, outlawing pay history questions and contributing to the broader effort to reshape compensation practices.

Illinois Pay Transparency Law – Public Act 103-0539

- Effective Date: January 1, 2025

- Coverage: Statewide

Employers Defined:

- Employers encompass individuals, organizations, and governmental entities with employees in Illinois.

Who is Affected:

- Employers with a workforce of 15 or more employees, whether the positions are performed partially or entirely in Illinois or are situated outside of Illinois but report to an Illinois-based supervisor, office, or work site.

Employer Requirements:

- Employers with 15 or more employees must include pay scale and benefits information in their job postings.

- Compliance is achieved by linking to a publicly accessible webpage containing this data.

- Current employees should be notified of promotion opportunities within 14 days of external job postings, with exceptions for specific positions within the Illinois workforce.

Use of Third Parties for Job Postings:

- When employers utilize third parties to advertise job openings, they must share the pay scale and benefits information or a hyperlink to it.

- The third party is responsible for including this data in the job posting.

- The third party bears the responsibility for compliance unless they can demonstrate that the employer failed to provide the necessary details.

Anti-Retaliation Measures:

- Employers are prohibited from obstructing or retaliating against employees who exercise their rights under this Act, including discussing wages or assisting others.

- Contracts or waivers preventing the sharing of wage, salary, benefits, or compensation information are not allowed.

- Exceptions exist for HR employees, supervisors, or individuals with access to wage details, who must obtain written consent before disclosing such information.

Recordkeeping:

- Employers must maintain records of pay scales, benefits, and job postings for each position, retaining these records for at least five years.

Excluded Factors for Pay Differences:

- Payment disparities due to seniority, merit, or productivity-based systems are not considered.

- Differentials based on factors other than sex, race, or any elements deemed unlawful under the Illinois Human Rights Act are not covered.

Key Notes:

- Employers are not obliged to post job listings but can fulfill the benefits requirement by maintaining an accessible webpage description.

- Employers and employment agencies can inquire about wage expectations, but they must disclose pay scale and benefits upon request, except when postings are available.

Penalties:

- Violations of this law may result in penalties ranging from $250 to $10,000, contingent on the number of offenses and job posting status.

Hawaii Pay Transparency & Equal Pay Law – SB1057 SD2 HD2 CD1

- Effective Date: January 1, 2024

- Coverage: Statewide

Who is Affected:

- Employers with 50 or more employees.

Employer Requirements:

- Specific job postings must include an hourly rate or salary range that “reasonably reflects” the anticipated compensation.

Equal Pay Measures:

- Prohibits employers from engaging in wage discrimination based on state-established protected categories for substantially similar work within the same establishment

Excluded Factors for Pay Differences:

- Pay differentials resulting from seniority, merit, or systems assessing earnings by quantity or quality of production are not subject to regulation.

- Bona fide occupational qualifications are excluded.

- Wage disparities based on permissible factors outside the protected categories outlined in section 378-2(a)(1) are not governed by this law.

Exceptions to the Legislation:

- This law does not apply to internal promotions or transfers within the same employer.

- It is not applicable to public job postings with compensation determined through collective bargaining.

Michigan Salary History Ban – Executive Directive 2019-10

- Effective Date: January 8, 2019

- Coverage: Statewide

Who is affected:

- State departments and autonomous agencies under the oversight of the governor, in accordance with Article V, Section 8 of the Michigan Constitution of 1963.

Prohibited Actions:

- Employers cannot inquire about a job applicant’s current or past salaries unless a conditional offer of employment is extended, accompanied by a proposed compensation explanation.

- Contacting current or previous employers or accessing public records to determine an applicant’s salary history is strictly prohibited.

- Employers with pre-existing job applicant compensation details cannot use this information in employment decisions unless mandated by law or a collective bargaining agreement.

Required Steps:

- Employers must take reasonable precautions to prevent the unintentional discovery of salary history while collecting other applicant information.

- Any inadvertently obtained salary history information must not influence employment decisions.

Important Notes:

- Employers are permitted to request and verify a job applicant’s current or previous compensation information before presenting a conditional offer of employment, provided the applicant voluntarily provides the data or when verification is legally required.

- The directive does not diminish any rights granted under a collective bargaining agreement or override any applicable laws.

Minnesota – Salary History Ban – SF 2909

Section 56. Minnesota Statutes 2022, 443.24 Subd. 8.

- Effective Date: January 1, 2024

- Coverage: Statewide

Who is affected:

- Employers, employment agencies, and labor organizations conducting business in Minnesota.

Prohibited Actions by Employers:

- Employers are prohibited from investigating, considering, or requesting the disclosure of an applicant’s pay history for determining wages, salary, earnings, benefits, or other compensation.

Exceptions to the Requirement:

- The prohibition against inquiring into the compensation history of an applicant does not apply if the applicant’s pay is a matter of public record under federal or state law, unless the employer accessed those records to determine the applicant’s compensation.

- Salary history may be considered if voluntarily disclosed by applicants without being asked, encouraged, or prompted by the employer, employment agency, or labor organization.

Other Key Notes:

- Employers may provide information about the pay and benefits for a job position, and they can inquire about applicants’ expectations or requests regarding pay and benefits.

New York Pay Transparency Law – Senate Bill S9427A

- Effective Date: April 1, 2024

- Coverage: Statewide

Who is affected:

- Any employer, employment agency, employee, or agent thereof advertising a job, promotion, or transfer opportunity to be performed, at least in part, in the state of New York is affected.

Employer Requirements:

- Job advertisements, promotions, or transfer opportunities intended for performance in New York must disclose the compensation or a compensation range for the respective position.

- The job description, if available, should also be included.

- Advertisements for positions with commission-based pay must comply by providing a written general statement indicating that compensation is commission-based.

- Employers are prohibited from denying interviews, hiring, promotions, employment, or retaliating against applicants or current employees for exercising their rights under the law.

Exclusions:

- Excludes advertisements for temporary employment at temporary staffing firms.

Penalties:

- Employers in violation of the law are subjected to a civil fine totaling $1,000 for the first violation, $2,000 for the second, and $3,000 for the third or any further violations.

Washington Pay Transparency Law – Senate Bill 5761

- Effective Date: January 1, 2023

- Coverage: Statewide

Who is affected:

- Applies exclusively to employers with 15 or more employees.

Employer Requirements:

- Employers must include in each job posting the wage scale or salary range and a general description of benefits and other compensation for potential hires.

- The term “posting” encompasses any solicitation for job applicants, whether made directly by an employer, indirectly through a third party, or electronically or in printed form, specifying qualifications for desired applicants.

- Upon request, when an employee is offered an internal transfer or promotion, the employer must provide the wage scale or salary range for the new position.

Exclusions:

- Excludes advertisements for temporary employment at temporary staffing firms.

Non-compliance Notes:

- Job applicants and employees have the right to seek remedies under Sections 49.58.060 and 49.58.070 for violations, with wage recovery and interest calculated from the date the wages were due.

Stay Informed, Stay Compliant:

Navigating the intricate web of state pay transparency laws is a challenging task for employers. However, staying informed about the regulations in your state and beyond is crucial for maintaining compliance.

About Astrix

Astrix is the unrivaled market leader in creating and delivering innovative strategies, solutions, and people to the life science community. Through world-class people, processes, and technology, we work with clients to fundamentally improve business and scientific outcomes and the quality of life everywhere.

Founded by scientists to solve the unique challenges of the life science community, Astrix offers a growing array of strategic, technical, and staffing services designed to deliver value to clients across their organizations.

Contact us to learn how our staffing and consulting services can help!

Disclaimer

This information is purely for educational purposes and is not intended to be used as legal advice. Please consult your legal counsel for any questions related to your business practices and policies related to applicable laws.

Case Study: LabWare Centralized Data Review for a Global Biopharmaceutical Company

Overview A global biopharmaceutical company specializing in discovery, development,... LEARN MOREWhite Paper: Managing Data Integrity in FDA-Regulated labs.

New White Paper LEARN MORELET´S GET STARTED

Contact us today and let’s begin working on a solution for your most complex strategy, technology and staffing challenges.

CONTACT US